Interest rates are an important financial lever for world economies. They affect the cost of borrowing and the return on savings, and it makes them an integral part of the return on many investments. It can also affect the value of the currency, which has a further trickle-down effect on other investments.

So, when rates are low they can influence more business investment because it is cheaper to borrow. When rates are high or rising, economic activity slows. As a result, interest rate movements are also a useful tool to control inflation.

The cash rate or headline rate you hear mentioned regularly in the media is the interest rate on unsecured overnight loans between banks. The Reserve Bank of Australia (RBA) sets the rate and meets every month, except January, to consider whether it should move up, down or stay the same. This rate then usually flows through to market interest rates causing, for example, mortgage rates to rise or fall.

Rising steadily

For the past few years, interest rates have been close to zero or even in negative territory in some countries, but that all started to change in the last year or so.

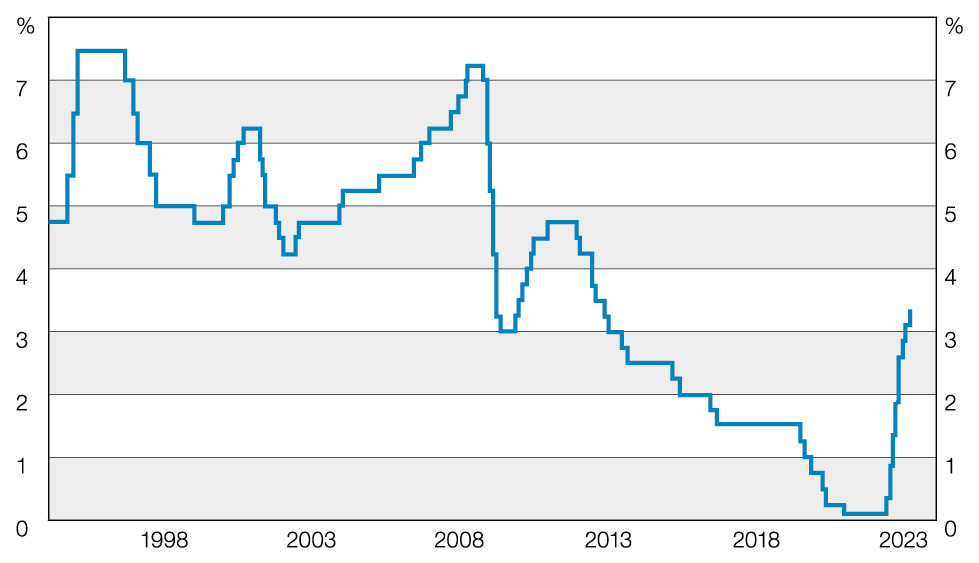

Australia lagged other world economies when it came to increasing rates but since the rises began here last year, the RBA has introduced hikes on a fairly regular basis. Indeed, the base rate has risen 3.5 per cent since June last year.

Australian Cash Rate Target

Source: RBA

The key reason for the rises is the need to dampen inflation. The RBA has long aimed to keep inflation between the 2 and 3 per cent mark. Clearly, that benchmark has been sharply breached and now the consumer price index is well over the 7 per cent a year mark.

While interest rates are the key monetary policy weapon to control inflation and dampen the economy, there can be a risk of taking it too far and causing a recession. Economic growth is forecast to slow to around 1.5 per cent this year as high inflation, low consumer confidence and rising rates take their toll.i

Winners and losers

There are two sides to rising interest rates. It hurts if you are a borrower, and it is generally welcomed if you are a saver.

But not all consequences of an interest rate rise are equal for investors and sometimes the extent of its impact may be more of a reflection of your approach to investment risk. If you are a conservative investor with cash making up a significant proportion of your portfolio, then rate rises may be welcome. On the other hand, if your portfolio is focussed on growth with most investments in say, shares and property, higher rates may start to erode the total value of your holdings.

Clearly this underlines the argument for diversity across your investments and an understanding of your goals in the short, medium, and long-term.

Shares take a hit

Higher interest rates tend to have a negative impact on sharemarkets. While it may take time for the effect of higher rates to filter through to the economy, the sharemarket often reacts instantly as investors downgrade their outlook for future company growth.

In addition, shares are viewed as a higher risk investment than more conservative fixed interest options. So, if low risk fixed interest investments are delivering better returns, investors may switch to bonds.

But that does not mean stock prices fall across the board. Traditionally, value stocks such as banks, insurance companies and resources have performed better than growth stocks in this environment.ii Also investors prefer stocks earning money today rather than those with a promise of future earnings.

But there are a lot of jitters in the sharemarket particularly in the wake of the failure of a number of mid-tier US banks. As a result, the traditional better performers are also struggling.

Fixed interest options

Fixed interest investments include government and semi-government bonds and corporate bonds. If you are invested in long-term bonds, then the outlook is not so rosy because the recent interest rates increases mean your current investments have lost value.

At the moment, fixed interest is experiencing an inverted yield curve which means long term rates are lower than short term. Such a situation reflects investor uncertainty about potential economic growth and can be a key predictor of recession and deflation. Of course, this is not the only measure to determine the possibility of a recession and many commentators in Australia believe we may avoid this scenario.iii

What about housing?

House prices have fallen from their peak in 2022, which is not surprising given the slackening demand as a result of higher mortgage rates.

Australian Bureau of Statistics data showed an annual 35 per cent drop in new investment loans earlier this year.iv The consequent reduction in available rental properties has put upward pressure on rents which is good news if you have no loan, a small loan or a fixed interest loan on the property.

The changing times in Australia’s economic fortunes can lead to concern about whether you have the right investment mix. If you are unsure about your portfolio, then give us a call to discuss.

i https://www2.deloitte.com/au/en/pages/media-releases/articles/business-outlook.html

ii https://www.ig.com/au/trading-strategies/what-are-the-effects-of-interest-rates-on-the-stock-market-220705

iii https://www.macrobusiness.com.au/2023/02/inverted-yield-curve-predicts-australian-recession/e.

iv <>https://www.abs.gov.au/statistics/economy/finance/lending-indicators/latest-release